Loancrate

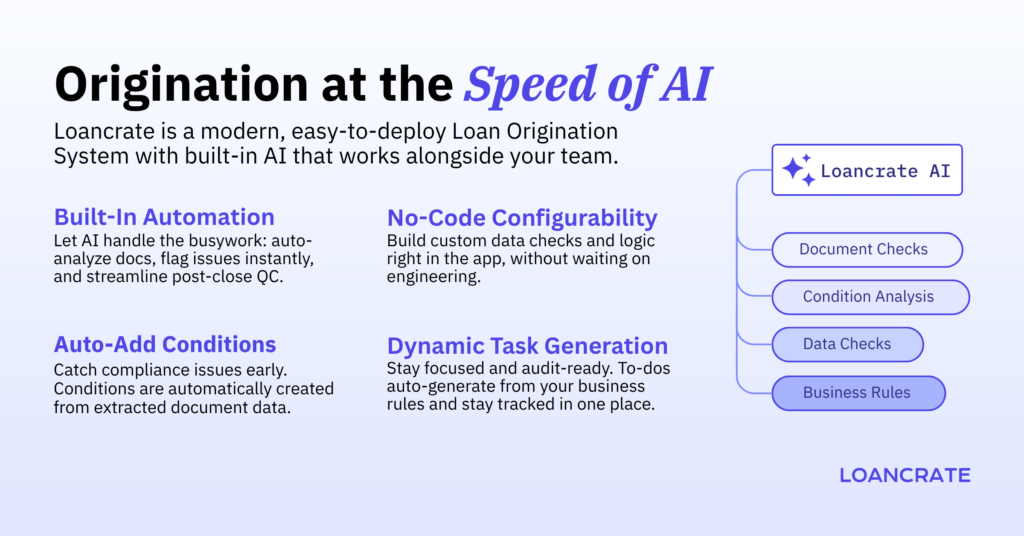

Loancrate is a web-based, AI-native Loan Origination System built for today’s mortgage lenders. It combines intelligent automation with flexible, no-code configurability—helping teams move faster, improve loan quality, and scale operations with confidence. Book a demo to see how Loancrate can streamline your lending workflow.

About

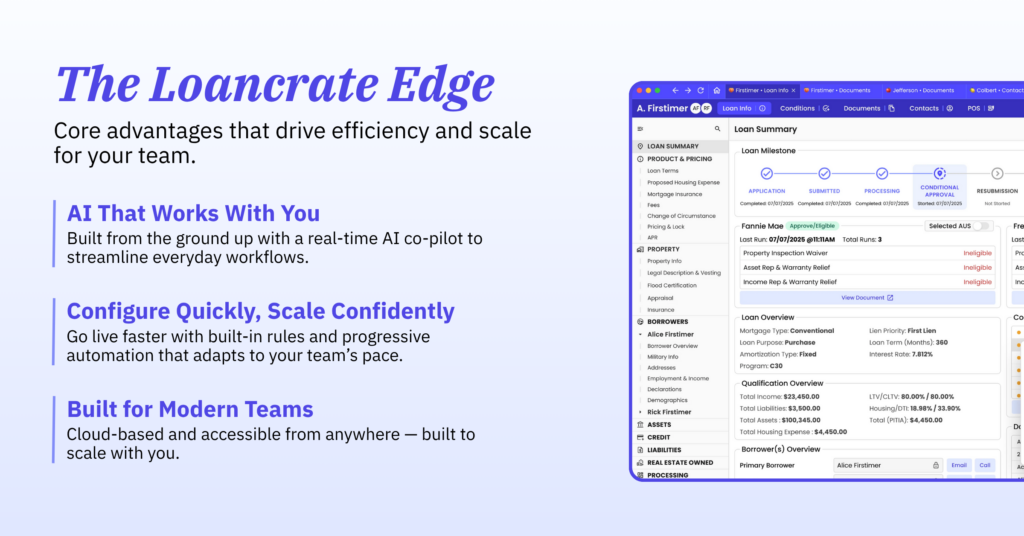

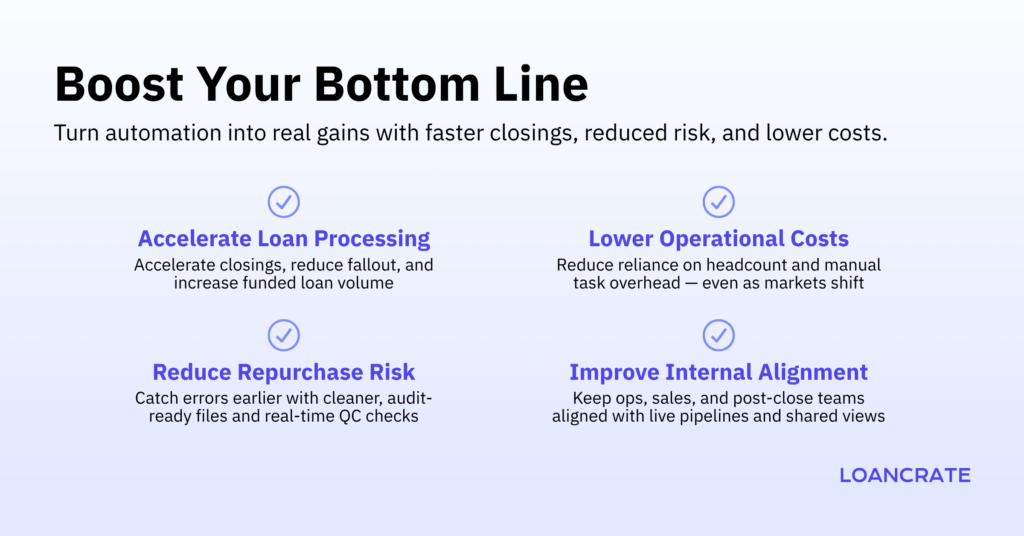

Built for scale and efficiency, Loancrate is a modern, web-based, AI-native Loan Origination System designed for mortgage lenders. Loancrate combines intelligent automation with no-code configurability to help teams accelerate processing, reduce risk, and scale without added overhead.

With built-in document analysis, real-time condition clearing, and dynamic task generation, Loancrate eliminates the manual steps that slow teams down. Ops leaders can configure business rules, logic, and workflows directly in the app—without waiting on IT—while shared pipeline views keep every team aligned from open to post-close.

Why lenders use Loancrate:

-

Automates document review, condition management, and task creation in real time

-

Improves team alignment with live pipeline views and dynamic to-do lists

-

Enables ops teams to manage changes with no-code configurability

-

Reduces repurchase risk with audit-ready files and built-in data validations

-

Scales with your team, without added staffing or system complexity

See how lenders are closing loans faster, reducing costs, and improving loan quality at loancrate.com.

Main Categories

Sub Categories

Industry Sectors

Deposit Banks

Independent Mortgage Banks

Credit Union

Products

Company Information

Showcase

Integrations

CRM

LOS

POS

Other

Contact Loancrate

"*" indicates required fields