For Lenders

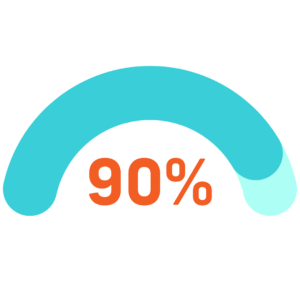

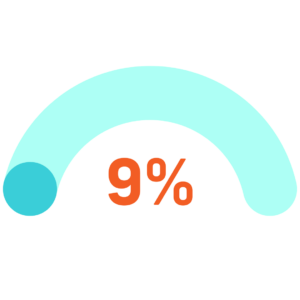

A recent survey reveals that 26% of lenders hesitate to invest in new technology due to doubts about its value, while 20% are unsure of what features to seek.

Buy with Confidence

At Mortgage Advisor Tools, we help lenders to facilitate their tech evaluation process. Our fresh take on tech stack audits enables mortgage lenders to fully understand the effectiveness of their current technology, assisting in well-informed decision-making.

We meticulously assess:

- Business model alignment

- User adoption rates

- Ease of integration

- Customization requirements

- Onboarding experience

- Usability for ongoing operations

- Quality of customer support

- Authentic user feedback

Everyone is seeking the keys to success, curious about what works, what doesn’t, and what new approaches are being tested. We excel by gathering data and sharing insights so you can be confident in your tech stack.

Ready to take the next step? Let’s chat!

Fill out the form and a friendly member of our team will get in touch. No pressure. No sales tactics. Tell us your story and we will see how we can help you reach your goals.